reit dividend tax rate 2021

22billion Current federal income tax including tax rebates. Ad Potentially Access Up To A 20 Tax Deduction On Qualifying Reit Income.

From a PFFO perspective CAPREIT trading at 21x appears to be expensive.

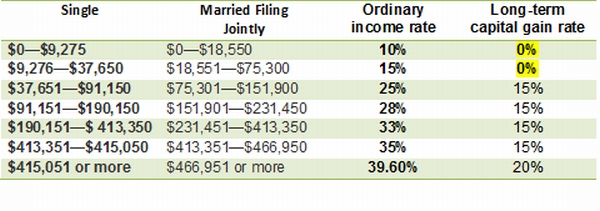

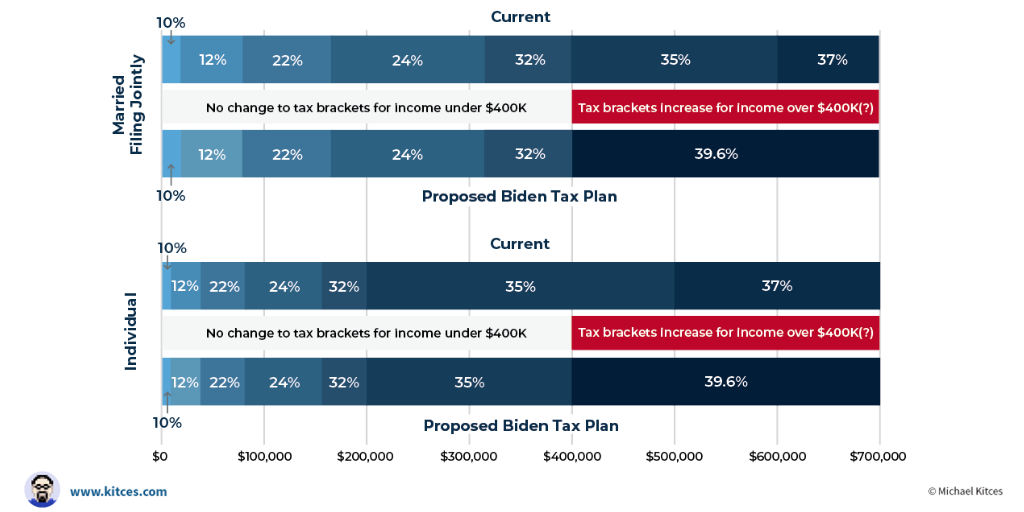

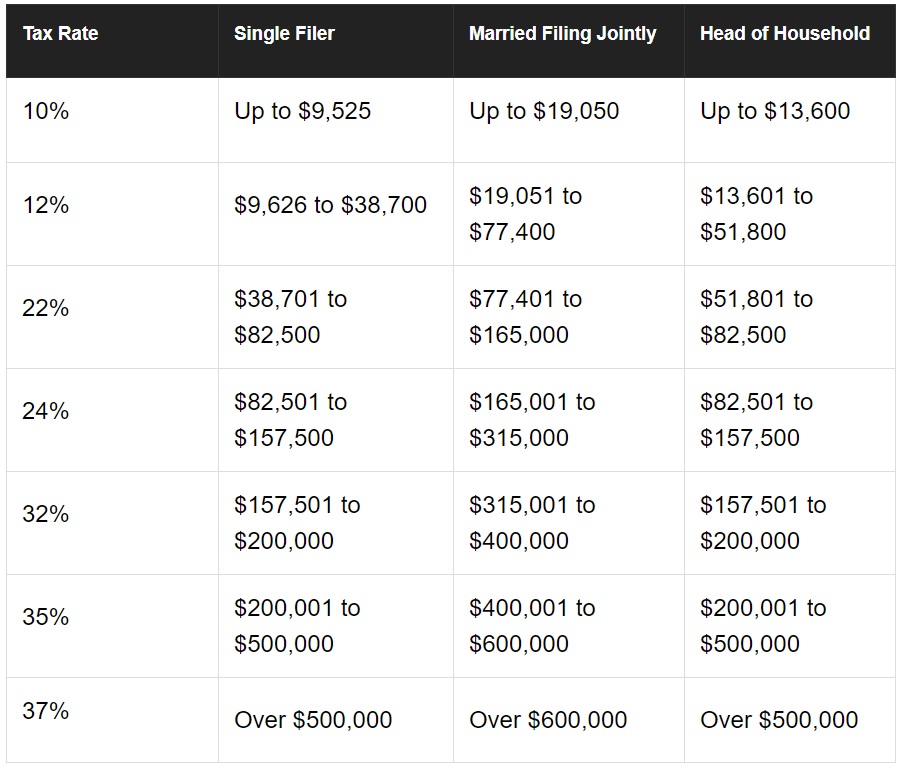

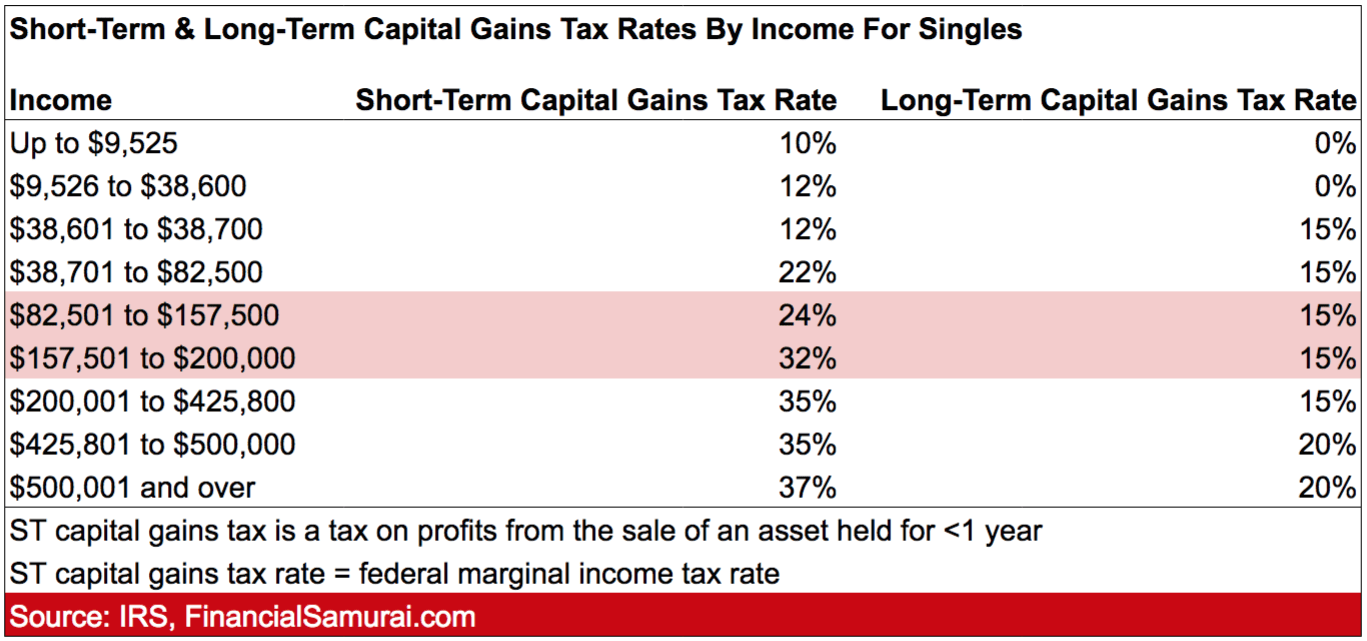

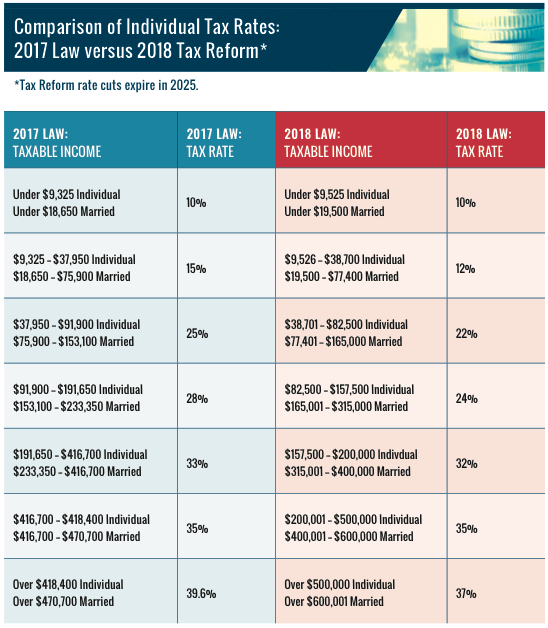

. The trusts can now raise debt capital at competitive rates while dividend payment to REITs and InVITs have been exempt from tax deducted at. Ad Potentially Access Up To A 20 Tax Deduction On Qualifying Reit Income. The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate 38 surtax on investment income.

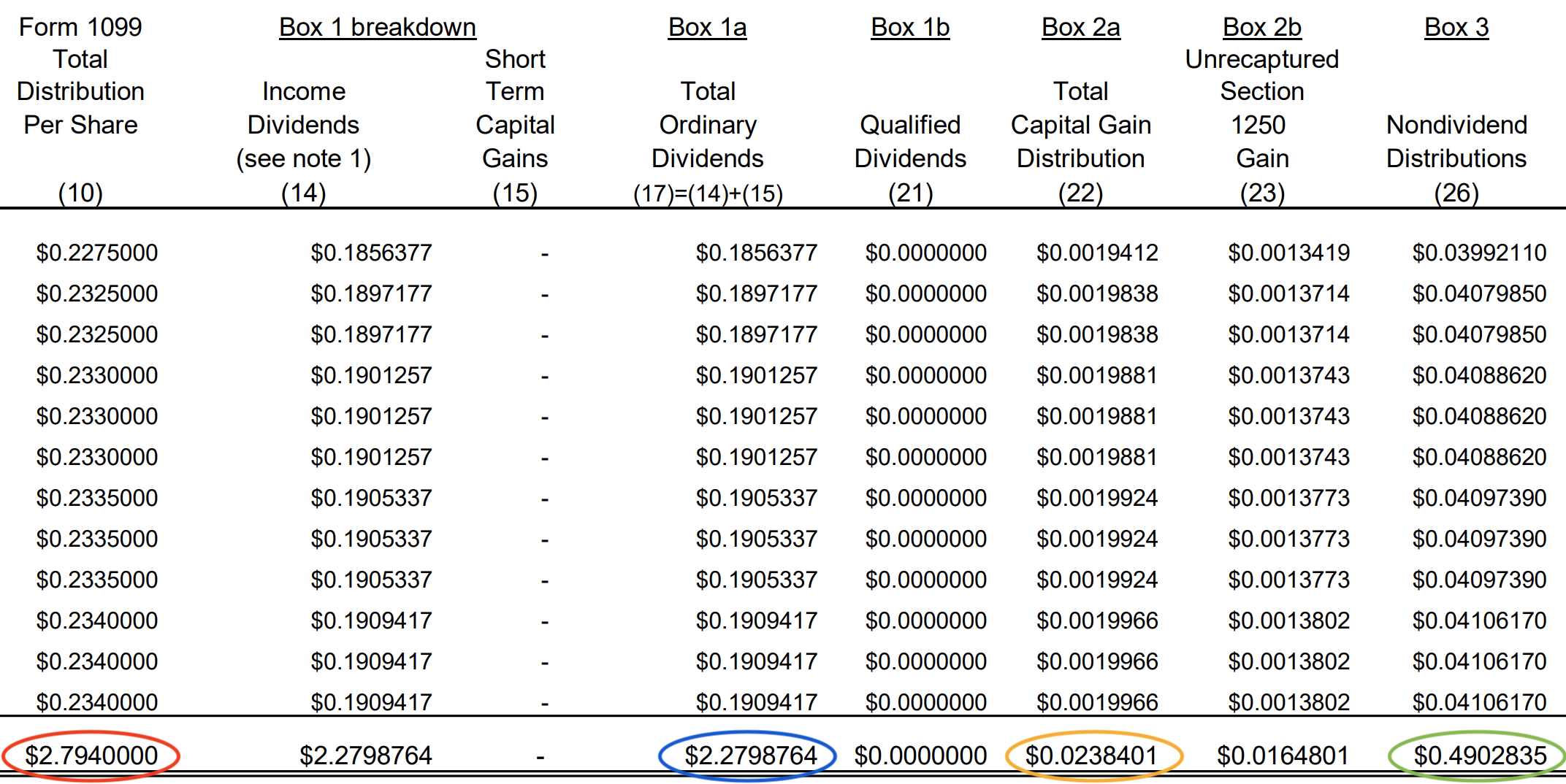

Dividends from real estate investment trusts or REITs are considered taxable income in the eyes of the IRS but theres much more to the story than that. Challenge the Old Buy Hold. This portion of qualified dividends gets taxed at lower capital gains rates.

The tax rate on nonqualified dividends is the same as your regular. A real estate investment trust or REIT is essentially a mutual fund for real estate. Challenge the Old Buy Hold.

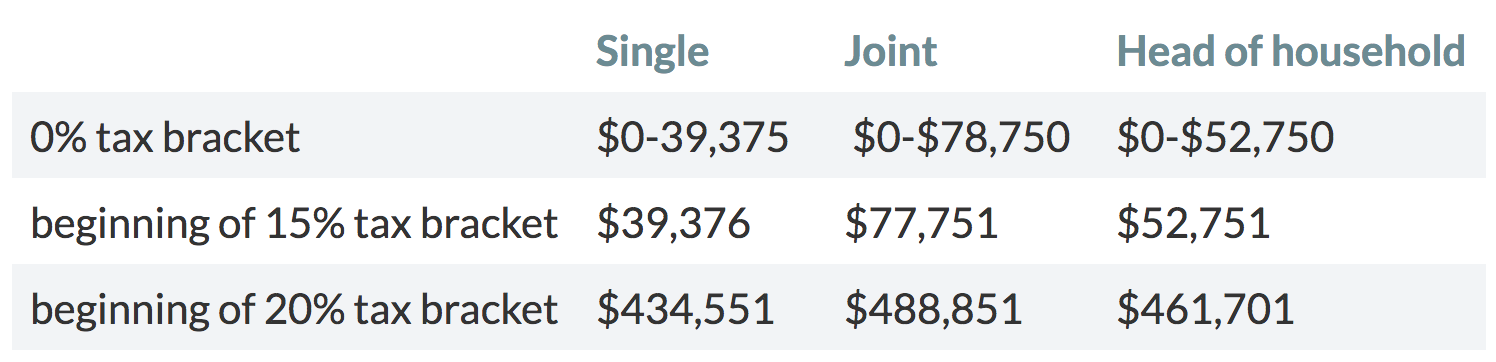

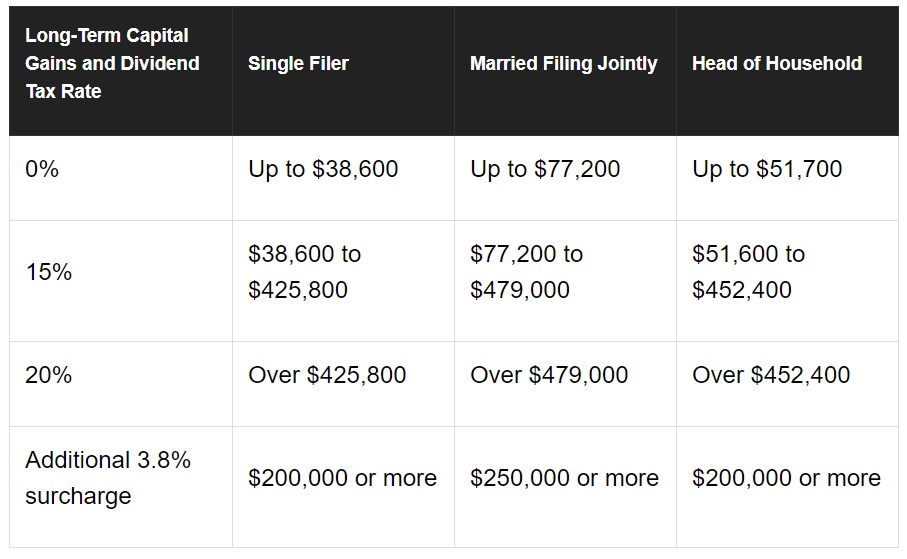

The tax rate on qualified dividends is 0 15 or 20 depending on your taxable income and filing status. 2021 Ordinary Dividend Tax Rate For Single Taxpayers For Married Couples Filing Jointly For Heads of Households. Union Budget 2021 India.

The tax rate on qualified dividends is 0 15 or 20 depending on your taxable income and filing status. In the past five years the company generated sufficient revenue to cover its. These ordinary dividends are taxed alongside your remaining income at the tax rate for which your overall income qualifies.

Get your free copy of The Definitive Guide to Retirement Income. While RICs can pass through qualified REIT dividends to their shareholders investors may in some. A look at the different dividend tax rates for 2021 and 2022.

The tax rates for non-qualified dividends are the same as. The tax rate on nonqualified dividends is the same as your regular income tax bracket. 40 billion Dividend yield.

Tax rate on dividends over the allowance. Real estate investment trusts REITs. REITs and Capital Gains Taxes.

Ad Learn the basics of REITs before you invest any of your 500K retirement savings. -138 million 10 lowest Effective tax rate. -64 26 lowest.

2 days agoGNL focuses on office and industrial properties with the goal to maintain a high occupancy rate. Fundrise just delivered its 21st consecutive positive quarter. Please refer to the table below.

2021 Qualified REIT Dividends. Beginning in 2018 until the end of 2025 if you are a taxpayer other than a corporation you are generally allowed a deduction of up to 20 of your qualified. 199A allows taxpayers to deduct 20 of their qualified REIT dividends.

49 Physicians Realty Trust DOC 1844 invests in medical office properties leased to national and large regional health. For companies such tax may be the normal rate of 25 plus surcharge and cess or the concessional rate of 22 plus surcharge and cess. 830 tax rate if.

American Electric Power US pre-tax income. Fundrise just delivered its 21st consecutive positive quarter. As of January 2 2013 the dividend and capital gains tax rate is 20 for investors making over 400000 and households making over 450000.

The interest and dividends received. 915 tax rate if shareholder owns more than 50 of the REITs voting stock. Ad Direxion Daily Real Estate Bull Bear 3X ETF.

Ad Direxion Daily Real Estate Bull Bear 3X ETF. However if you incorporate the unrealized gains of its investment properties the dividend. To work out your tax band add your total dividend income to your.

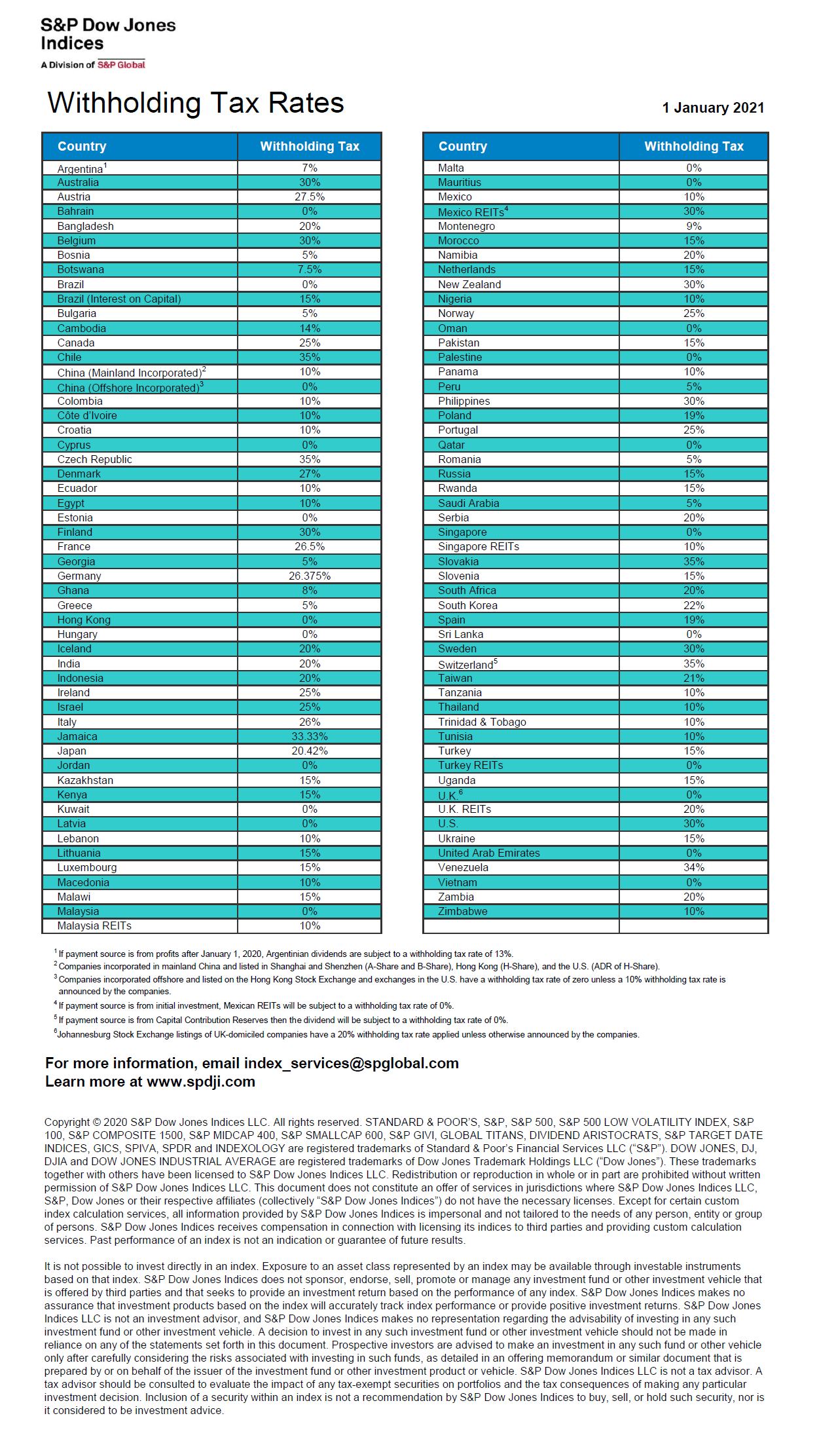

710 if shareholder owns at least 10 of the REITs voting stock except in the case of Jamaica and no more than 25 of the REITs income consists of dividends and interest. Your dividends would then be taxed at 15 while the rest of your income would follow the federal income tax rates. PID dividends are normally paid after deduction of withholding tax at the basic rate of income tax 20 which the REIT pays to HMRC on behalf of the shareholder.

Biden Tax Plan And 2020 Year End Planning Opportunities

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Guide To Taxes On Dividends Intelligent Income By Simply Safe Dividends

What You Need To Know About Capital Gains Tax

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

Real Estate Or Stocks Which Is A Better Investment

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

What You Need To Know About Capital Gains Tax

Income Types Not Subject To Social Security Tax Earn More Efficiently

Your Financial Advisor Is Wrong About Reit And Bdc Dividends Seeking Alpha

Corporate Tax In The United States Wikiwand

Dividend Tax Rates In 2021 And 2022 The Motley Fool

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Dividend Tax Rate 2022 Rates Calculation Seeking Alpha

Dividend Withholding Tax Rates By Country For 2021 Topforeignstocks Com

Sec 199a And Subchapter M Rics Vs Reits

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

What Stock Market History Tells Us About Corporate Tax Hikes In 2021 Stock Market Stock Market History Corporate Tax Rate